Insurtech, a blend of “insurance” and “technology,” refers to the use of technology innovations designed to squeeze out savings and generate efficiency within the current insurance industry model.

Setting up sales appointments with individuals in the insurtech industry stands apart as a challenging task, compared to appointment setting in other sectors.

Challenges in Appointment Setting with Decision-Makers in Insurtech Industry

Sales teams struggle with insurtech appt. setting for multiple reasons and key among these are:

Competition & Market Saturation

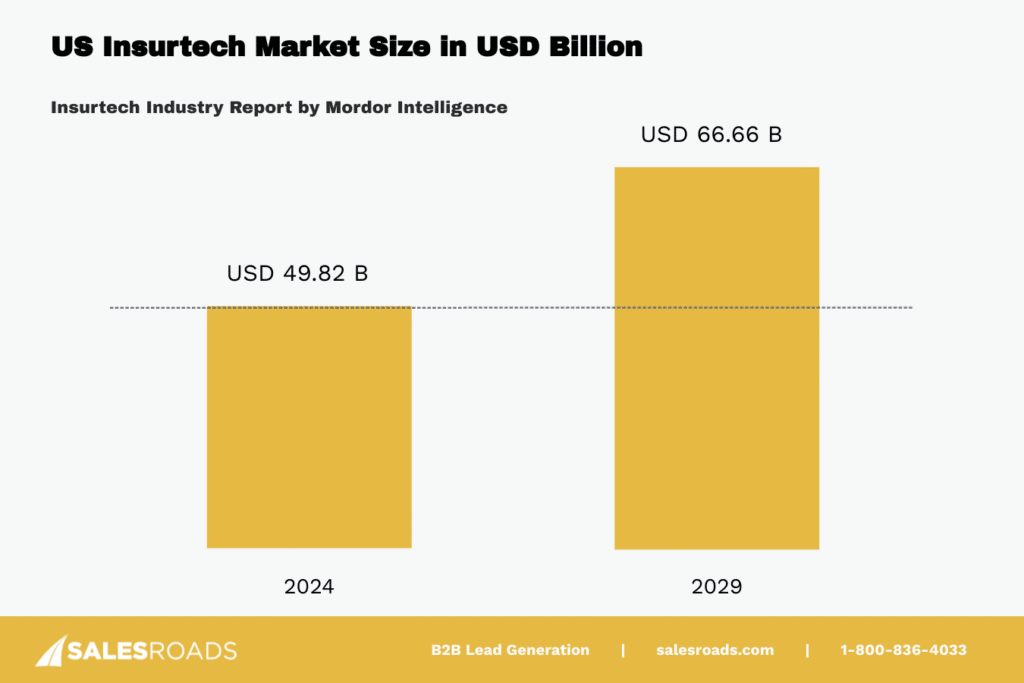

The insurtech industry has seen a significant influx of new entrants and investment, leading to a crowded and competitive environment. The U.S. Insurtech market, the largest globally, is projected to expand from an estimated value of $49.82 billion in 2024 to approximately $66.66 billion by 2029.

A prime hub for insurtech companies, the US market is witnessing substantial market growth, which makes reps struggle to differentiate their product so developing a unique value proposition is more crucial than ever.

Sales reps should highlight distinct features, proven ROI, and customer success stories in their outreach. Clearly communicating how their solution addresses specific insurtech challenges sets a product apart.

Evolving Landscape and Rapid Industry Evolution

The insurtech industry’s rapid technological, regulatory, and market changes pose a significant challenge for sales reps. Decision-makers are often too busy adapting to these changes to meet new vendors unless a clear and immediate value proposition is presented.

This evolving landscape means that what was relevant a few months ago may no longer be pertinent so reps should be agile and up-to-date. They must create compelling, concise value propositions that resonate with current industry trends and needs. Keeping informed through industry reports and news is vital.

Outdated Databases

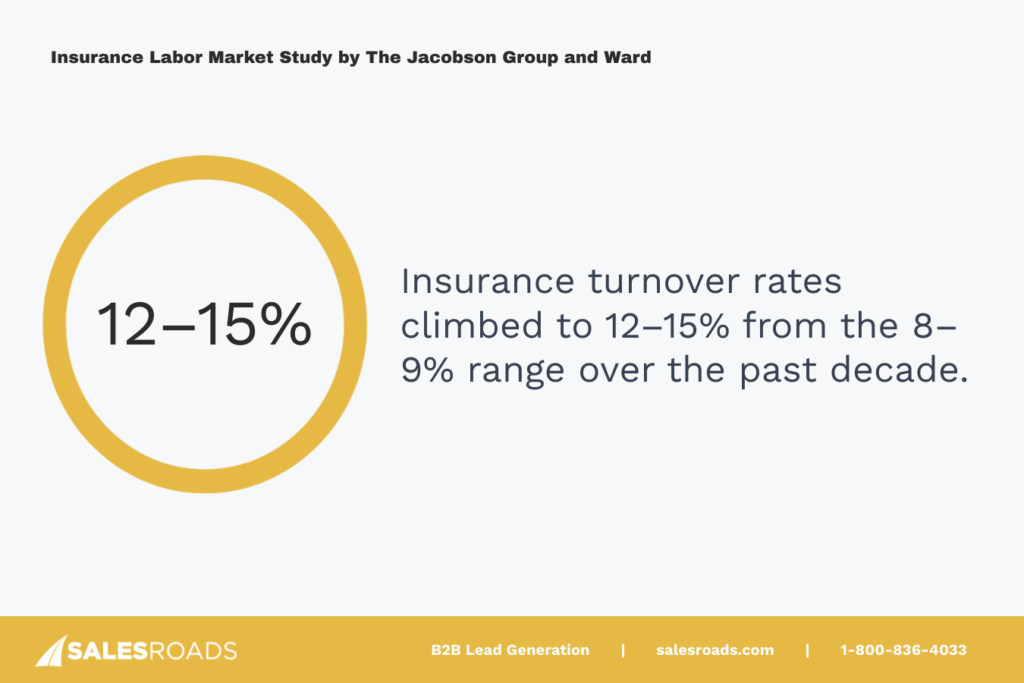

In the current landscape, reaching the right insurance decision-makers has become increasingly difficult for sales reps. Over the past decade, the industry has witnessed a notable shift in staffing dynamics, with turnover rates soaring from the 8-9% range to the more prevalent 12-15%.

With a decrease of 85,000 employees in U.S. insurance carriers since 2020, it’s evident that companies are facing new hurdles in retaining talent. Amidst this evolving environment, effective data management in retaining accurate prospect lists becomes indispensable to navigate and succeed.

To tackle this challenge head-on, it is paramount to establish a dedicated data operations team tasked with regular maintenance and refinement of the database. This ensures that the contact info provided to reps remains accurate, relevant, and up-to-date.

Tech-Savvy Audience and Specialized Market Knowledge

Insurtech’s tech-savvy decision-makers, well-versed in insurance and technology, often challenge sales reps. They are skeptical about new solutions that don’t clearly improve upon or integrate seamlessly with their existing tech stack.

Reps must exhibit deep knowledge of both technology and insurance. This involves detailed research into the prospect’s current tech stack, operational challenges, and industry-specific needs. Reps should be prepared to discuss technical details and integration processes and show a clear understanding of how their product adds value to the existing systems.

Data Security Concerns

Data security is paramount in insurtech, with companies handling sensitive customer data. A report from IBM finds insurance was the second-most attacked industry in 2023, representing 18.2% of global incidents.

This highlights the persistent threat to both insurtech companies and their partners.

Sales reps face skepticism from decision-makers wary of new technologies that could jeopardize data security. To overcome this, reps must be knowledgeable about data security practices and compliance standards relevant to the industry. Articulating their product’s security features and compliance convincingly is essential. Providing examples and case studies can effectively demonstrate a commitment to data security.

Multiple Stakeholders & Decision-Maker Accessibility

In insurtech companies, decision-making often involves multiple stakeholders, each with unique priorities. A sales pitch that appeals to a technical manager might not resonate with a financial controller. This diversity complicates appointment-setting, as sales reps must resonate with each stakeholder’s specific concerns.

Sales reps need to conduct thorough research to understand the roles and interests of different stakeholders within their target company. They should develop tailored messages that address the specific needs and concerns of each stakeholder and offer flexible meeting formats to accommodate busy schedules.

Why Outsourcing is an Effective Strategy for Appointment Setting with Insurtech Decision-Makers?

The fast-paced and complex world of insurtech presents unique challenges for sales reps seeking appointments with key decision-makers. These obstacles require specialized knowledge and refined skills to navigate effectively. Building this expertise internally can be a significant investment of time and resources.

Outsourcing appointment setting to a vendor with deep experience in the insurtech sector offers a streamlined approach to achieving sales goals. Here’s how:

Deep Understanding of the Insurtech Landscape

Specialized vendors possess a wealth of experience tailored to the insurtech sector. Their knowledge goes beyond the basics, encompassing the regulatory landscape and decision-making process. They understand the ever-evolving regulatory environment within insurtech, allowing them to tailor outreach strategies accordingly and have a clear grasp of the internal power dynamics and approval processes within insurtech companies.

This translates to better-targeted outreach.

Access to a High-Quality Insurtech Network

Outsourcing partners typically maintain extensive databases of key decision-makers within the insurtech space. Their dedicated research teams constantly update and verify these contacts. This expertise in identifying the right people is invaluable.

Instead of relying on generic prospect lists, you get access to a network that’s not only accurate but also hyper-focused on your target audience within insurtech.

Flexibility and Scalability Tailored to Your Needs

Sales needs can fluctuate, especially in a dynamic industry like insurtech. An outsourcing partner can scale their services up or down to match your current requirements. This ensures you’re not overstaffed during slow periods or understaffed during peak times.

Focus on Closing Deals, Not Prospecting

When your Account Executives (AEs) spend a significant amount of time prospecting, it can take away from their core strength: closing deals. Outsourcing allows them to focus on nurturing qualified leads and securing sales, while AEs handle prospecting.

Faster Pipeline Growth with Specialized Strategies

By leveraging their specialized knowledge and proven sales techniques, an outsourcing provider with an insurtech focus can generate a higher volume of qualified appointments compared to an in-house team lacking this specific industry expertise. This translates to a more robust sales pipeline for your business.

Case Study: Our Client’s Transformation in Booking Sales Appts with Insurtech Companies

For an inside look at how outsourcing can be an effective tool for reaching insurtech decision-makers, we want to share the story of one of our clients:

The Challenges They Faced in the Insurtech Appt. Setting Before SalesRoads

Before partnering with SalesRoads, they struggled to manage and optimize their inside SDR team for effective engagement with insurtech sector decision-makers. Their efforts lacked the impact and precision needed for successful outreach, overwhelmed by unclear and imprecise data.

Their VP of Sales, aware of these internal limitations, championed a strategic shift towards external expertise in the insurtech industry appointment setting. Their extensive search led them to SalesRoads.

How SalesRoads Helped?

Once SalesRoads stepped in, the transformation in their appointment setting strategy was immediate and striking. Within a mere 90 days, the results were so impressive that they redirected all their resources to SalesRoads:

- SalesRoads tackled their database issues by employing scraping and scrubbing tools for data cleansing and enrichment, ensuring accuracy and reliability. They established internal protocols for ongoing data hygiene, leading to 16.2% of right-party contacts (RPCs) converting into appointments.

- SalesRoads designed and implemented a structured process specifically tailored to handling and progressing “hot leads.” This approach significantly increased engagement and led to a 66.4% appointment hold rate.

- Addressing their lag in responding to inbound leads, SalesRoads introduced a rapid response system, contacting leads within 60 seconds, maximizing SQLs generated:

- To engage website visitors preferring direct calls, SalesRoads set up an inbound calling system, enabling immediate lead engagement and appointment setting, enhancing their sales funnel efficiency.